Dunning-Kruger Market

- We are in a Dunning-Kruger (“DK”) market.

- These market environments are driven by a positive-feedback loops.

- In such periods, investors conflate skill and luck.

- Financial Innovation is often an undercurrent supporting a DK market.

What is DK?

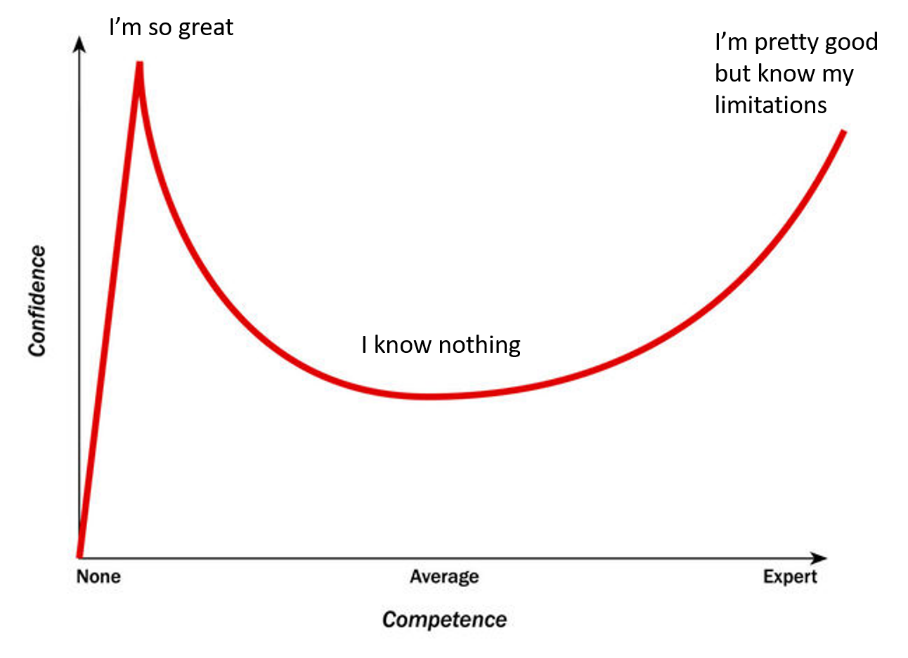

The Dunning-Kruger Effect is a cognitive bias, often cited within the field of behavioral economics. It posits individuals with lower capability in tasks will overestimate that ability. The inverse also holds, where experts underestimate their perceived ability. The below chart shows a spectrum of competence plotted against commensurate confidence. You can think about your own education in any practice as a trek across the x-axis. An initial wave of ‘irrational exuberance’ is followed by a trough of disillusionment. Finally, a climb towards expertise comes with a tempered acknowledgment of one’s circle of competence.

This effect was discovered by psychologists David Dunning and Justin Kruger, studying Western college students. It, like many behavioral biases, has fallen prey to the controversy surrounding the replication crisis. There is peer-reviewed literature which counters its existence. But setting aside controversies, DK is a useful mental model when applied to financial markets. This is because discounting complex systems can conflate luck and skill. When luck and skill get mixed, Dunning-Kreuger exists.

Misinformation

Dunning-Kruger “has more to do with being misinformed rather than uninformed.” – David Dunning

The above-quote by Dr. Dunning helps sharpen our understanding. Misinformation is more important than ignorance in causing the Dunning-Kruger effect. This is quite apt when applied to investing where quality of information can be hard to discern, especially in periods of technological change.

Take a first-time stock investor, who just got into markets during quarantine. Chances are, they were lured into the market during the doldrums of COVID, armed with new technology in the form of millennium-friendly zero-commission brokerage apps. They source investment decisions through social information channels: funnels like Reddit, video tutorials from Instagram and increasingly TikTok. Followers counts and likes are more important and financial underwriting and reasoning:

They are attracted to stories around disruptive technologies, associating their potential success with that of today’s tech giants. They place value on social cohesion (‘group buying’), and they have distrust of established financial institutions. This backdrop is a breeding ground for misinformation rather than sensible security valuation.

Feedback loops

“In the short-run, the stock market is a voting machine. Yet, in the long-run, it is a weighing machine.” – Warren Buffett (paraphrasing Ben Graham)

The DK effect is pernicious in a positive feedback environment. Take 2020, a year of fantastic, outsized dispersion in equity markets. After March, tail-risk management acted as a headwind; blind risk-taking was rewarded. First-order thinking was the most profitable trade: long WFH tech, short experiential services. And so, 2020 was a year where some retail investors had fantastic, outsized returns. This made investing for the uninitiated seem quite easy and self-promotion through these platforms an exercise of survivorship bias.

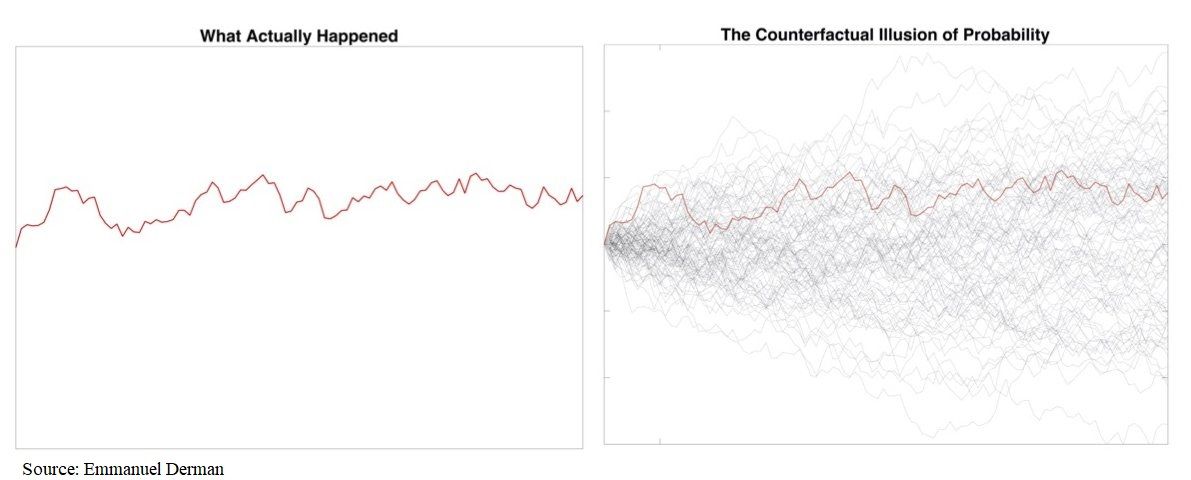

In positive feedback loops, equilibrium is destabilized, and expertise is unrewarded. Expertise is important in mapping probability distributions and thinking of priors. Specifically, mean-reversion is a de facto anchor for the expert. Mean reversion epitomizes a negative feedback loop. For example, when looking at a company trading at lofty valuations (say double-digit multiple of sales), the security analyst thinks of the base case rather than the exception and adjusts her future expectations (i.e., “Expensive! Sell!”). This is in stark contrast to a DK approach. Trend-following is all that is required to profit, and it works magically in a positive feedback environment. It is the simplest of algorithms, and its recent success belies any probabilistic thinking or decomposition of base-rates. In such a momentum environment, markets begin to untether from valuation, making experts seem all the more foolish.

Nothing Lasts Forever

“Markets can remain irrational longer than you can remain solvent.” – J. Maynard Keynes

With experts having egg on their face, DK investors lean into an almost nihilistic discourse. This can rationalize otherwise pure speculation. Every TikTok investing video forwarded to me pokes fun at short-sellers and professionals as chicken-littles. They point to outsized moves in crypto or meme stocks as proof that expertise is de mode. In some sense, they are right?

But DK environments can’t last forever. To start 2021, we’ve had spells of market instability that may portend a new regime of mean reversion. Even as the prevailing wisdom surrounding expensive tech stocks has been challenged – and sharply haircut – a weird sub strand of DK is still visible in altcoins and ‘meme’ stocks. The pessimist might simply call these ‘pump’ situations. While the macro environment feels riper for a return to normalcy, shorting notable absurd moves in meme stocks or junk coins is something one must approach with significant caution.

Financial Innovation: Aiding and Abetting

Similar to other periods of speculative excess, financial innovation is proving the willing facilitator of DK markets. For example, the light regulatory oversight of forward-looking statements in SPAC mergers acts as adrenaline to a momentum-driven trade. SPAC momentum (not unlike an ‘IPO pop’) is predicated on layering short term incentives (warrants for ground-floor buyers, fees for promoters, oversized valuations for the target companies) at the cost of long-term shareholder performance. The same goes with the mysteriously hypothecated wealth associated with DeFi crypto-yield faming, or even Gamma squeezes being conjured by the explosion of retail option trading.

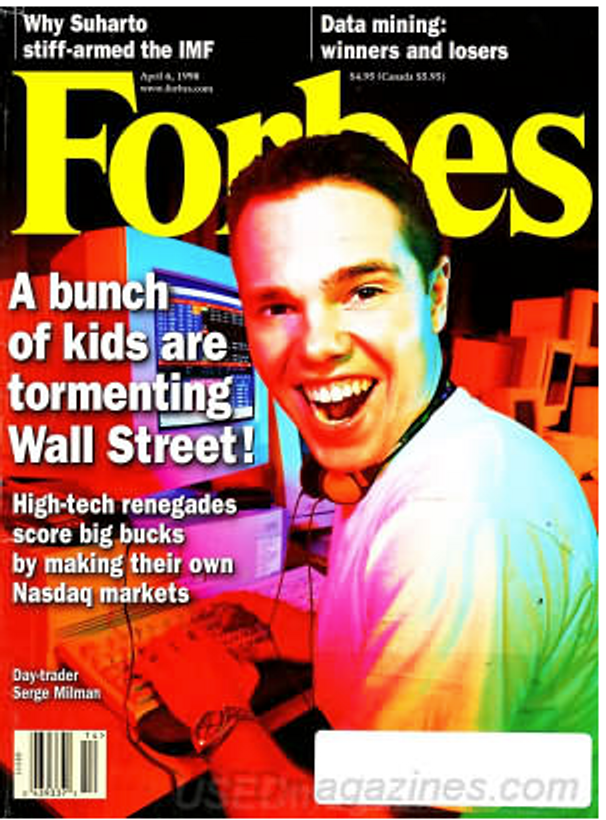

There are historical parallels. These include increased risk-appetite for MBS by institutional investors leading up to 2008, the proliferation of online brokerage platforms in the late 1990s and the first internet chat-forums for stocks. Note the Forbes cover above is from 1998, not January 2021! We also saw increased equity exposure by institutional allocators leading into 1987 stemming from portfolio insurance and index futures.

What each of these situations have shown us is the latent danger hiding beneath the surface of momentum-driven DK markets. Unchecked, these will almost certainly lead to poor capital allocation decisions and real wealth destruction. To survive a Dunning-Kruger market, judicious security selection and mental resolve from FOMO are absolutely necessary. It is interesting to see venerable investors, who have navigated such environments well in the past, being pilloried for being ‘lost in the times.’ Perhaps this time is different, but hey, what do they know.

---

The information contained in this article was obtained from various sources that Epsilon Asset Management, LLC (“Epsilon”) believes to be reliable, but Epsilon does not guarantee its accuracy or completeness. The information and opinions contained on this site are subject to change without notice.

Neither the information nor any opinion contained on this site constitutes an offer, or a solicitation of an offer, to buy or sell any securities or other financial instruments, including any securities mentioned in any report available on this site.

The information contained on this site has been prepared and circulated for general information only and is not intended to and does not provide a recommendation with respect to any security. The information on this site does not take into account the financial position or particular needs or investment objectives of any individual or entity. Investors must make their own determinations of the appropriateness of an investment strategy and an investment in any particular securities based upon the legal, tax and accounting considerations applicable to such investors and their own investment objectives. Investors are cautioned that statements regarding future prospects may not be realized and that past performance is not necessarily indicative of future performance.