How Alignment of Interest Unlocks Performance Potential

Principal-Agent (PA) problems have persisted for quite some time. In investing, the dynamic between principal (LP) and agent (GP) has seen a change in sentiment in the last 10 years. There has been increased cynicism towards heads I win, tails you lose economic models. Like many hidden problems which become apparent when the tide recedes, PA has been a hot button issue in active management. Large institutions have come out with proposals and standards to tackle these problems, but they chip away at the fringes of a broader problem, which are about control and trust. Let’s take a step back and discuss what are the most glaring issues as it pertains to PA problems in institutional investing.

Fees

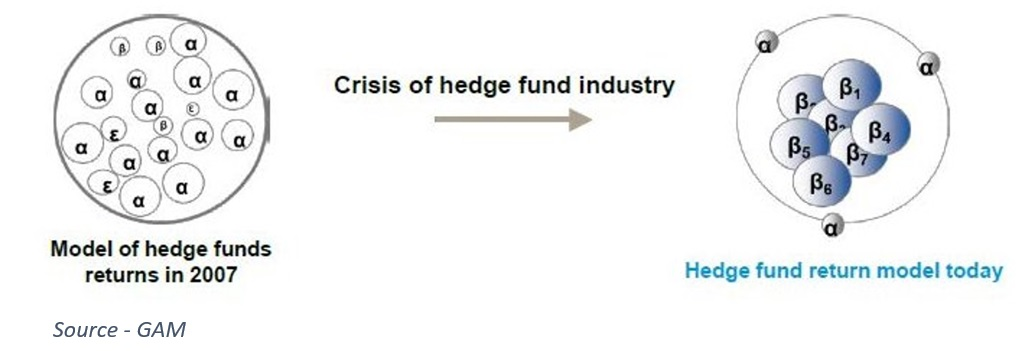

Perhaps the elephant in the room is fees. This was not a huge topic when active management was the primary means of investing (before the proliferation of passive options), nor was there a clamor around alternative fees when they generated high median alpha to investors. As both dynamics have changed over time, fees have become centerfold in not only alternatives but traditional asset management. While there are myriad reasons why, fundamentally two things have occurred:

- Beta has become effectively free

- Alternative assets under management have grown, heightening competition and reducing consistency of firm-level outcomes

The traditional 2/20 model, which evolved almost out of habit rather than through transparent and competitive price discovery, is under significant threat, and so investors are increasingly skeptical to either high management or the very presence of incentive fees.

Transparency

Several noted acts of malfeasance in the investment space put a heightened focus on transparency, but the fundamental PA issue is that the intellectual property that GPs use to generate alpha for LPs can be arbitraged once made public. For this very reason, there remains significant secrecy in practice, especially in many forms of quantitative asset management.

Liquidity

Winning liquidity concessions from LPs is another example of something that was acceptable for strategies that require a match between terms and underlying investments (think non-marketables), but transformed into a means of sheltering the profitability of the GP. While gates and rolling locks are on the decline, fund managers are still nervous about grass is greener LPs abandoning them at inopportune times and causing stampedes out of their funds. Liquidity as a PA problem is the most overlooked and can often be the greatest source of capturing structural alpha.

Potential Solutions

Ultimately, how adversarial these three are is a micro phenomenon; a function of the desirability of each GP in the eyes of the LP community. However, we believe this status quo leaves the door open for disruption from customer-centric GPs that can think long-term and those that can win long-term LPs.

By providing total concessions on liquidity, transparency, and fees, Epsilon hopes to generate significant scale, allowing us to further strengthen our offering (especially on fees), perpetuating our business model. We base this perspective on the almost antithetical approach Jeff Bezos and Amazon have taken in creating a modern powerhouse through this inverted, long-term approach.

In short, we want to tackle some of the thorniest PA problems in the institutional investment space as a means of driving value to our clients and differentiating our value proposition. This requires deep and meaningful relationships with our LPs who we can trust to understand our process during the inevitable bouts of short-term turbulence. This gives us the fortitude to share full transparency and provide daily-liquidity, something we hope they would never need. As our scale increases, we can extend the olive branch by lowering fees to truly spin this flywheel. We didn’t invent this business approach, but we want to bring it to active management.

---

The information contained on this site was obtained from various sources that Epsilon believes to be reliable, but Epsilon does not guarantee its accuracy or completeness. The information and opinions contained on this site are subject to change without notice.

Neither the information nor any opinion contained on this site constitutes an offer, or a solicitation of an offer, to buy or sell any securities or other financial instruments, including any securities mentioned in any report available on this site.

The information contained on this site has been prepared and circulated for general information only and is not intended to and does not provide a recommendation with respect to any security. The information on this site does not take into account the financial position or particular needs or investment objectives of any individual or entity. Investors must make their own determinations of the appropriateness of an investment strategy and an investment in any particular securities based upon the legal, tax and accounting considerations applicable to such investors and their own investment objectives. Investors are cautioned that statements regarding future prospects may not be realized and that past performance is not necessarily indicative of future performance.