Investment Consistency: Search for the Holy Grail

Consistent performance is perhaps as coveted as outperformance. Consistency puts fears to rest and provides flexibility. But consistency is hard to come by, especially when outperformance is the intent, and even more-so when market beta is a core component of return. So how can investors enjoy outperformance with consistency? It depends what type of consistency you are looking for and the investment strategy at work.

Consistency of Alpha for Fundamental Portfolios

We’re of the mindset that consistency with fundamental portfolios comes down to the quality of process, decision making, and the ability of the practitioners to evolve with the world. This is an extremely challenging hurdle given the behavioral biases that impact managers who witness success (fame, fortune, hubris) and their ability to keep the organization moving forward through time (talent, style, transient edge).

It’s equally hard for allocators to determine the true consistency of a manager. First, there is an inherent sampling bias of managers that are brought to the attention of the allocator (e.g., failures aren’t pitching large checks). The lucky evolutionary winners are lauded as examples, and their process is then rationalized as superior. What’s loss is often a true understanding of causal significance. To make matters worse, the “window of action” on hot ticket items is often at a period where statistically significant data can’t be collected. Act or miss out. Finally, some investment styles may not be conducive to demonstrating repeatability (e.g., concentrated/low number of positions). We think these are key reasons why time-weighted returns of successful GPs are invariably superior to the dollar-weighted returns of their LPs.

Consistency of Alpha for Quantitative Portfolios

Quantitative portfolios traditionally seek to arbitrage an anomaly in the market, or to ride a trend that has been deemed predictive of superior risk-adjusted future performance. If these signals are truly unknown to the broader market, they can be harvested by clever managers, providing a conduit for repeatable alpha. Truly smart quantitative firms layer orthogonal strategies upon each other, increasing the probability of consistent outcomes.

Think about it this way: if you can run a casino and setup enough 51% winning games on top of each other, your ability to generate a consistent day-over-day profit increases as the number of uncorrelated games at play increases. This perhaps is the one silver bullet that investors can enjoy: the ability to increase investment consistency through the layering of truly orthogonal alpha.

There are two problems with this from the investor’s standpoint. First, with a lack of transparency into how these anomalies are exploited, there will be heightened agency issues. Second, true orthogonality is like an uncertainty principle; extremely difficult to know it when you see it. With a lack of transparency into the anomaly, the LP is left trusting the GP, which causes a Principal-Agent problem. With an inability to be certain about true orthogonality, they may introduce significant tail-risk in aberrant market conditions.

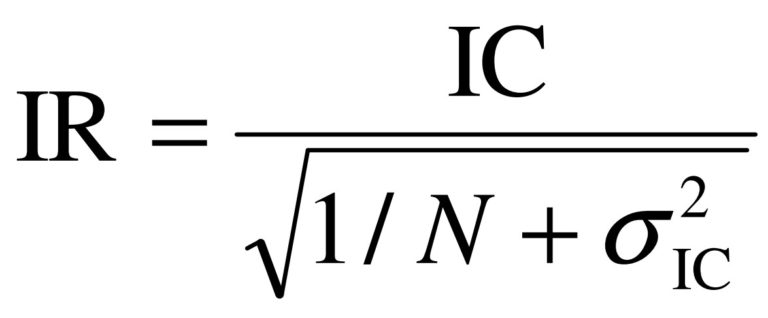

Grinold and Kahn’s Fundamental Law of Active Management

Epsilon’s Approach to Consistency

Understanding consistency from both sides (fundamental / quantitative) allows us to marry the best of both worlds in our pursuit of consistency. We want to be entirely process driven and scientific in our approach so our portfolios can adapt to market evolution as well as competition. By applying the scientific method to fundamentally derived theses, we attempt to nullify our own behavioral biases and drive investment consistency. By looking at thousands of data points across dozens of time steps, we attempt to create statistically significant data signals applied across the entire universe of securities to create repeatable, consistent results. Ultimately, it is an approach aimed to drive superior dollar-weighted returns to our clients.

The information contained on this site was obtained from various sources that Epsilon believes to be reliable, but Epsilon does not guarantee its accuracy or completeness. The information and opinions contained on this site are subject to change without notice.

Neither the information nor any opinion contained on this site constitutes an offer, or a solicitation of an offer, to buy or sell any securities or other financial instruments, including any securities mentioned in any report available on this site.

The information contained on this site has been prepared and circulated for general information only and is not intended to and does not provide a recommendation with respect to any security. The information on this site does not take into account the financial position or particular needs or investment objectives of any individual or entity. Investors must make their own determinations of the appropriateness of an investment strategy and an investment in any particular securities based upon the legal, tax and accounting considerations applicable to such investors and their own investment objectives. Investors are cautioned that statements regarding future prospects may not be realized and that past performance is not necessarily indicative of future performance.