Reflexivity

This excerpt was taken from our investor 4Q21 letter, dated January 4th 2022.

…the alchemist made a mistake in trying to change the nature of base metals by incantation. Instead, they should have focused their attention on the financial markets, where they could have succeeded. – George Soros

It is our belief that capital markets are becoming increasingly reflexive. They are more financialized, reflecting flows ahead of fundamentals and all that entails. There has been tangential discussion about this in the financial media. Much of it surrounds active/passive assets. We launched Epsilon 5 years ago with a belief that the market needed investment options that deliver the best of both worlds. Since then, we’ve witnessed new trends in market structure, including the rise of retail-driven small-batch option-trading, coordination / meme stocks, incredulous valuations, and the exponential growth of digital assets. Let’s unpack the current market dynamic through the lens of reflexivity.

First, let’s define the term reflexivity, coined by legendary investor George Soros. It describes circular relationships between cause and effect that exist in social systems (social sciences such as economics, psychology). This contrasts with physical systems that have direct, causal effects (sciences such as chemistry, physics, or astronomy). The classic example in financial markets is the daily news headline, which prescribes causality: Dow Jones up 350 points on optimism about new bill. But which is the cause, and which the effect?

Soros’ beliefs were not only shaped by his time in the markets but also his interest in philosophy. This was shaped by the writings of Karl Popper. Popper was a central philosopher in explicating the role of science within humanity’s pursuit of knowledge. He frames science’s role as falsification through prediction, explanation, and testing. Building upon this, Soros questions the application of Popper’s framework to the social sciences. His central claim being these fields have a reflexive structure of knowledge – making falsification problematic. Quoting Soros:

Consider the statement ‘It is raining.’ That statement is true or false depending on whether it is, in fact, raining. And whether people believe it is raining or not cannot change the facts. The agent can assess the statement without any interference from the manipulative function and thus gain knowledge. Now consider the statement ‘I love you.’ The statement is reflexive. It will have an effect on the object of the affections of the person making the statement and the recipient’s response may then affect the feelings of the person making the statement, changing the truth value of his or her original statement.

Reflexivity in Markets – Earnings Response

Market prices of financial assets do not accurately reflect their fundamental value because they do not even aim to do so. Prices reflect market participants’ expectations of future market prices. – George Soros

Let’s walk through the quintessential example of a causal phenomenon in markets: the earnings response. Earnings releases are amongst the most important information sources for security evaluation. They are audited and released on a regular cadence by regulated entities. They contain “standardized” metrics, interpreted through the language of accounting. Upon their release, markets digest the information, and stock prices change.

This impulse-driven change in stock price after release is known as the Earnings Response Coefficient (“ERC”). It, like it’s cousin the Post Earnings Announcement Drift (“PEAD”), is a metric we can aggregate[1] and monitor over time across the market. The trend in domestic equities has been an overall reduction in ERC over the last few decades. Some researchers would interpret this trend as increasing efficiency. But that movement has not been unidirectional. The oscillation of ERC over time can be a useful prism for understanding reflexivity in markets. Let’s frame this through a simplification of historical eras over the last few decades.

Era 1 could be called Arbitrage for the Fleet Footed. Before digital information made financial data infinitely cheaper to arbitrage, simply having earlier access to physical copy provided an alpha opportunity. We’ve all read stories about the investment firms of lore, couriering paper to their investment teams faster than their peers[2]. That allowed them to reposition before the broader market was able to digest and reflect information. In this sense, the ERC had more delay versus today because information spreads slower, but the actual response shortly after release may have been muted. As arbitrage worked its magic in increasing efficiency, ERC should then increase.

Fast forward to more recent times, and you have a period of Arbitrage for the Well Connected. Prior to Reg FD (circa 2002), a growing class of competitive investment firms pushed the limits of earlier access to information and thus its absorption. To compete in a more challenging environment, these firms often sought edge through corporate access that – at the time –legally conveyed information before its broad and equal dissemination. In this period, earnings response were thus partially incorporated prior to the earnings release. Again, here we have a less than expected earnings response, as marginal buyers/sellers of a security have already positioned into the earnings announcement. Of course, with the passing of Reg FD and the increasing digitalization of information, the zero bound of an earnings release became more important, and the race was on to model earnings data not only upon its equal and fair dissemination, but to estimate its impact prior to release through alternative data sources.

This ushered in the Era of Alternative Data. As efficacy[3] in these data sources was proven, acquiring alt data increasingly became table stakes for firms that ‘played’ earnings announcements. From a game theoretic perspective, as the degree of alt data saturation increased, the ERC has increased in large part because of competitive positioning. Firms that position into earnings based upon their statistical analysis of alternative data run into a collective under-or-over positioning based upon those signals. This is most pronounced on securities where a single data point (e.g., net subscribers) is the metric of importance. These signals are not effective truth; rather, they provide statistical approximation through samplings and correlations. The false signals that invariably occur lead to larger than expected swings, as active traders reposition aggressively after release, widening the ERC.

We now reside in the Meta Era, where investors who acquire alt data aren't treating an alt-data-driven view as a variant perception. Rather, they accept that the information will likely be partially contained in the market prior to release, attempt to gauge whether the co-positioning of other actors is excessively skewed towards the approximate view, and re-position should that view be ‘offsides’. The Meta Age has a slew of interesting implications and is textbook market reflexivity at play.

The Reflexivity ATM – Access to Lower Cost of Capital

A trend we’ve discussed in the past is access to cheaper cost of capital and how this is quintessentially reflexive. Traditional finance theory would suggest that a company’s weighted average cost of capital is driven by its financial performance, its capital structure, and its credit worthiness. The entire business of calculating WACC is thought to be quite actuarial, feeding into the scientific sense of financial calculations.

More recently, we’ve seen the importance of shaping narrative in adjusting cost of capital. The germ of this goes as far back as Amazon’s IPO in 1995. Amazon’s importance, through their goods and services, is far reaching. Their importance on capital markets is profound. They effectively taught corporate America that shaping the narrative around long-term profitability can lower one’s immediate cost of capital, delay one’s need to inflect profitability, thus improving the likelihood of ultimately achieving it through maniacal reinvestment[4]. This is text-book reflexivity.

More than twenty-five years later, the next generation founders have read Amazon shareholder letters. They hold the company’s execution, innovation, and corporate culture as the gold standard. For those less focused on using doors as desks, a key takeaway was using branding, mission, and personality to lower their WACC. This is particularly effective with securities that call to retail investors. The nexus of these companies lies in fields of innovation and disruption – what we’ve previously discussed as boom firms. Because a long-term payout is uncertain, capital market access can significantly impact boom firm success.

Reflexivity and access to cheaper cost of capital is not a panacea. Virtuous cycles can flip and become vicious. Unprofitable companies with uncertain paths to future free cash flow, sporting inflated market caps face a double-edged sword. Innovation and disruption cuts both ways: profitless disruption simply invites further disruption by the next crop of venture back unicorns. There are indeed many nascent industries that do not suggest a steady-state equilibrium of any profitability whatsoever.

The SPAC mad dash of 2020 and 2021 was arguably a release valve for unprofitable private ventures to find liquidity in the embrace of receptive (and increasingly reflexive) public markets. As we’ve seen in prior cycles, financial innovations that are designed to transform risk can perversely mask it, leading to instabilities and ultimately sharp corrections. The ability for SPACs to push to the future the cost of dilution, to perversely increase the cost of accessing capital markets versus the traditional IPO, and to inflate valuations through incredulous revenue growth disclosures, is a clear and present risk.

Meta-Reflexivity, or how Venture Capital Will Eat the World

While we have seen reflexive cheapening of cost of capital in the public markets, this is a trend born in the private markets. Convincing a single LP can upwardly adjust valuations, a far more powerful ratchet effect. In 2011, venture investor Marc Andreessen wrote a now infamous piece titled “Software Will Eat the World.” It is our contention that Venture Capital is attempting to Eat the World. The apotheosis of this is the $100bn IPO of a pre-revenue car manufacturer.

There are some interesting reflexive wrinkles to these world-beating IPOs: the publicity around an IPO is increasingly important for the actual product, not only the ability of the business to finance the product. New issuers are attempting to develop tighter relationships with their retail customers: affording them access to their IPOs in exchange for product deposits and product usage.This accelerates brand loyalty, spinning the reflexivity wheel.

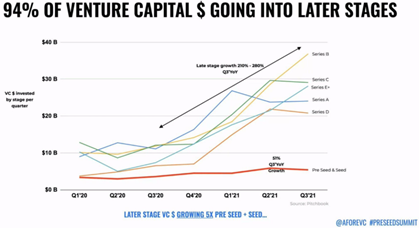

IPOs today provide exits for venture capitalists in companies that have radically uncertain futures. Irrespective of their long-term success, otherwise unrealized profit is recycled back into the private ecosystem at higher marks and later stages, re-rating the next raft of companies that are growing at all cost with a distant focus on steady-state profitability:

Returning to Soros, the problem with a positive-feedback reflexive loop is that the cycle eventually catches a glimpse of reality. From here, an unwind can foment. In 2021, we’ve witnessed unwinds in the most speculative pockets of the public markets, delivering significant pain to growth investors. These high-flying companies have been cut down 25-75%+, while broader market indices have remained relatively tame. Even so, the multiples of many of these companies remain elevated against any normal standard. All it takes is a shift in broader investor psyche or a tightening of cost of capital for a truly debilitating unwind to take root, with severe consequences for the entire ecosystem. Let us not forget that Amazon underwent a 90% drawdown during the tech bubble collapse.

Reflexivity and Portfolio Management

As long as the music is playing, you’ve got to get up and dance – Chuck Prince

In many ways, Chuck Prince (former Citigroup CEO and Chairman) quote encapsulates the dilemma facing active investors. As recently as 2015, many fund managers were reluctant traffickers of growth stocks. As performance between growth and value has incessantly yawned, the tide has turned and enthusiasm for growth has been as full-throated as ever. Skeptics are labeled boomers, or out-of-touch. Many have been unable to keep up with the pressure to deliver performance. Even with the recent plunge, many growth stocks remain multi-baggers over this medium-term period.

As we mentioned in prior letters, our approach to managing this type of ‘boiled frog’ risk is to think clearly about how our portfolios can be prone to groupthink and extended valuation. In a best case scenario, they should represent a heterogeneity of thought; ideas from contrarians, value-types, permabears, and megabulls. It is when that heterogeneity turns into groupthink that we should be worried, and these bouts do occur when complacency becomes the status quo.

Our prescription has always been to construct strict rules around portfolio rebalancing in order to protect our portfolios from over-extending and crashing. Updating our priors at each rebalance period allows us to protect capital as regimes change. Systematic rebalancing keeps us from trying to time when the music stops.

[1] As standardized as earnings reports are, there is significant heterogeneity across facets of earnings, such as choice of auditor (see Teoh and Wong 1993 as it pertains to auditor choice on ERC), type of firm, and of course the impact of guidance which is less standardized. Easton and Zmijewski (1989) lay claim to ERC variation being cross-sectionally valid.

[2] This is not unlike the pursuit of faster information relay in the form of microwave towers and high-speed fiber-optics.

[3] Efficacy here does not mean absolute accuracy but enough edge to generate alpha in a statistically significant fashion.

[4] The reciprocal during this era might have been GE, which managed earnings and the Street to such a degree that they were able to inflate a financial services business which delivered banner profits only to ultimately blow up through overreach.

---

The information contained in this article was obtained from various sources that Epsilon Asset Management, LLC (“Epsilon”) believes to be reliable, but Epsilon does not guarantee its accuracy or completeness. The information and opinions contained on this site are subject to change without notice.

Neither the information nor any opinion contained on this site constitutes an offer, or a solicitation of an offer, to buy or sell any securities or other financial instruments, including any securities mentioned in any report available on this site.

The information contained on this site has been prepared and circulated for general information only and is not intended to and does not provide a recommendation with respect to any security. The information on this site does not take into account the financial position or particular needs or investment objectives of any individual or entity. Investors must make their own determinations of the appropriateness of an investment strategy and an investment in any particular securities based upon the legal, tax and accounting considerations applicable to such investors and their own investment objectives. Investors are cautioned that statements regarding future prospects may not be realized and that past performance is not necessarily indicative of future performance