Smiling Curves & The Alternative Asset Allocation Spectrum

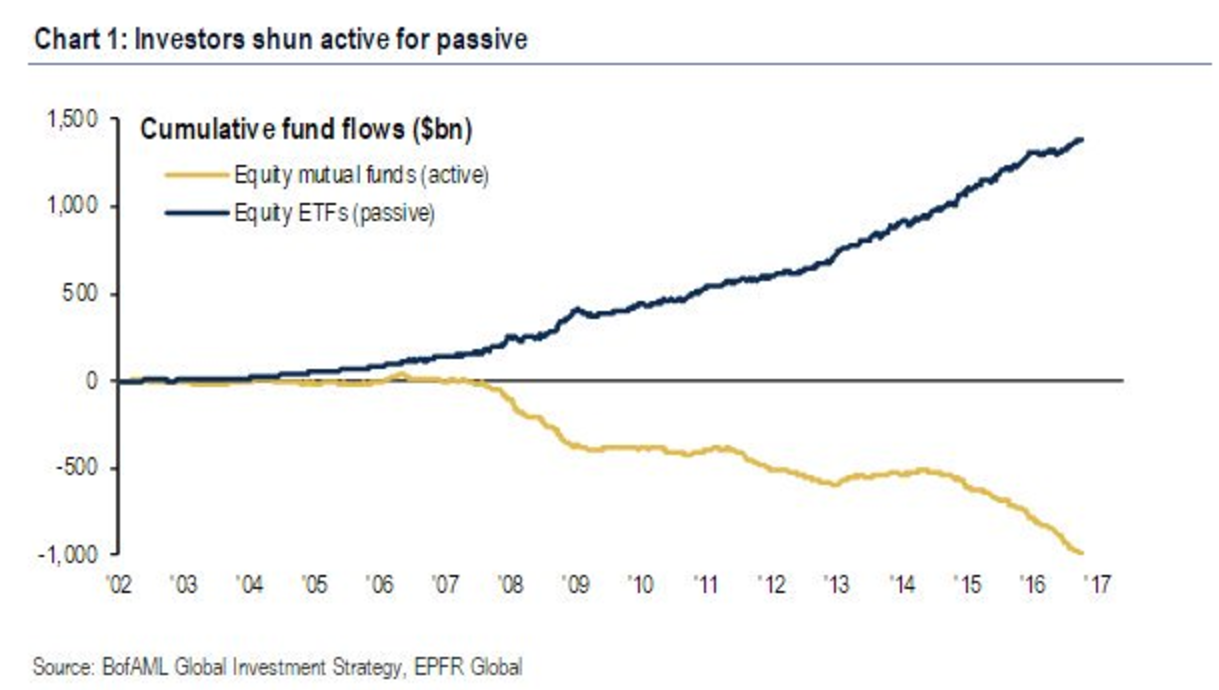

Fee compression in asset management is a hot button subject, and something we’ve written about. One only need to look at the wave of capital flight from active to passive to understand why it garners so much attention:

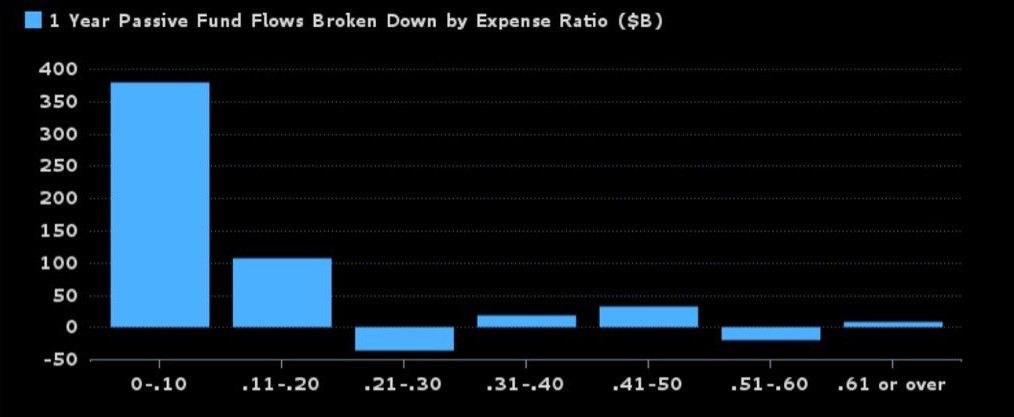

It’s even more amplified within passive, as the accrual of flows is falling to the commodity scale players who can offer the lowest expense ratios, such as Vangaurd, and iShares (chart from Eric Balchunas at Bloomberg):

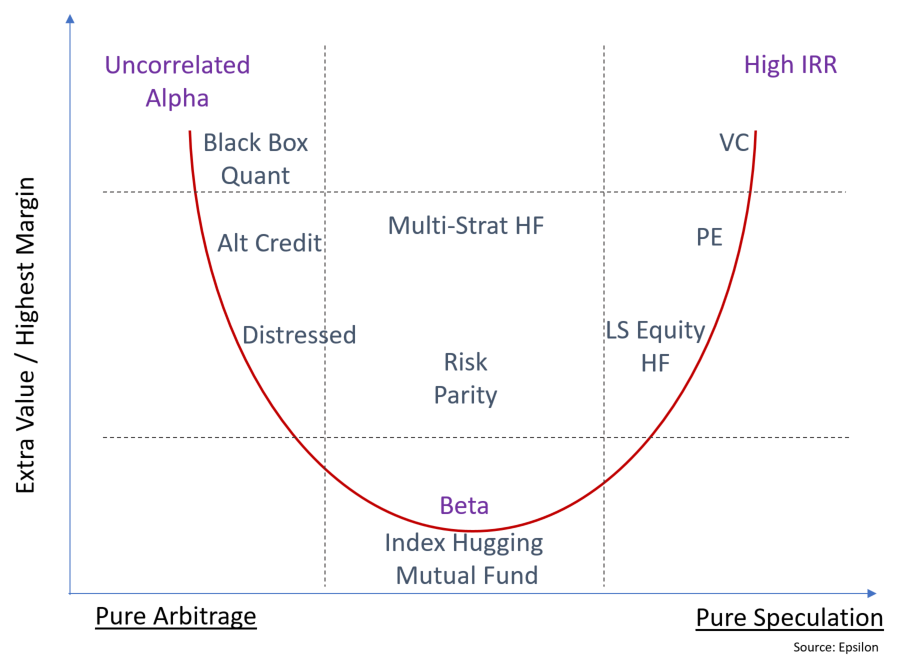

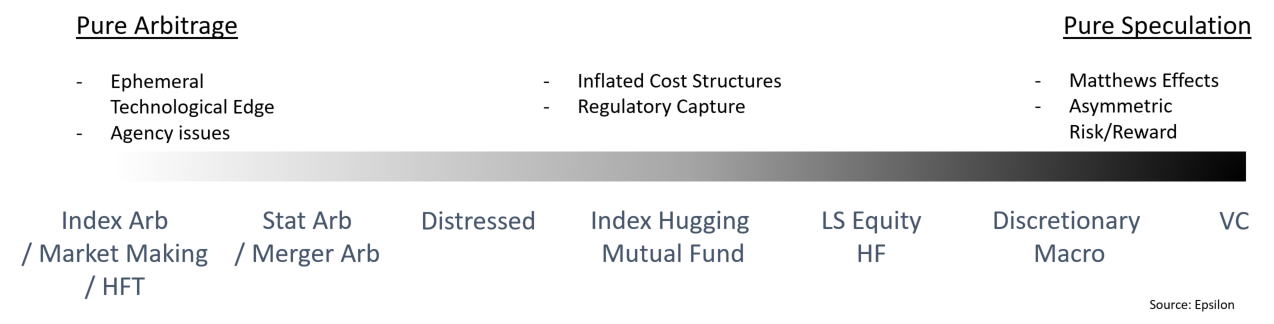

Putting active vs passive aside, across the spectrum of asset allocations we see a more nuanced story with clear winners and losers. Private equity and venture have been large winners in this cycle, while hedge funds have been far choppier. For this piece, we propose organizing the spectrum of active sub-classes across two poles: arbitrage and speculative strategies.

Pure arbitrage lies at one end, and pure speculation on another. Investment strategies gradate across the two. This continuum can help unpack how desirability across sub-asset classes is perceived, measured by investor demand. We demonstrate perceived value somewhat creatively through the lens of Stan Shih’s Smiling Curves of Profitability Theory.

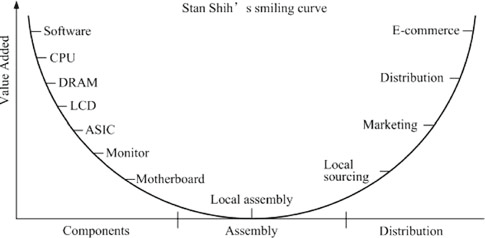

Shih (the founder of Acer) applied the thesis of smiling curves to understanding how profit accrues to different parts of technology supply chains. If you were to analyze the components of a desktop PC, the profitability of each part ends up falling into the ends of R&D (software, and microprocessor design), and services/distribution (brand management, marketing, and sales):

The wings differentiate their offerings and drive value. People love iOS and thus iOS can charge a premium in the form of abnormal profits for iPhones. The same goes for the app storm, a platform business. However, the portion of the supply chain in the belly wins no profit, as it holds no pricing power around its commoditized offering.

If you indulge us with our application of this framework, the analog to the supply chain for active management asset strategies is an arbitrage/speculation continuum where “value add” has bar-belled. The rise of low-fee passive investment options has pushed the value-add to the different ends of the arbitrage/speculation spectrum:

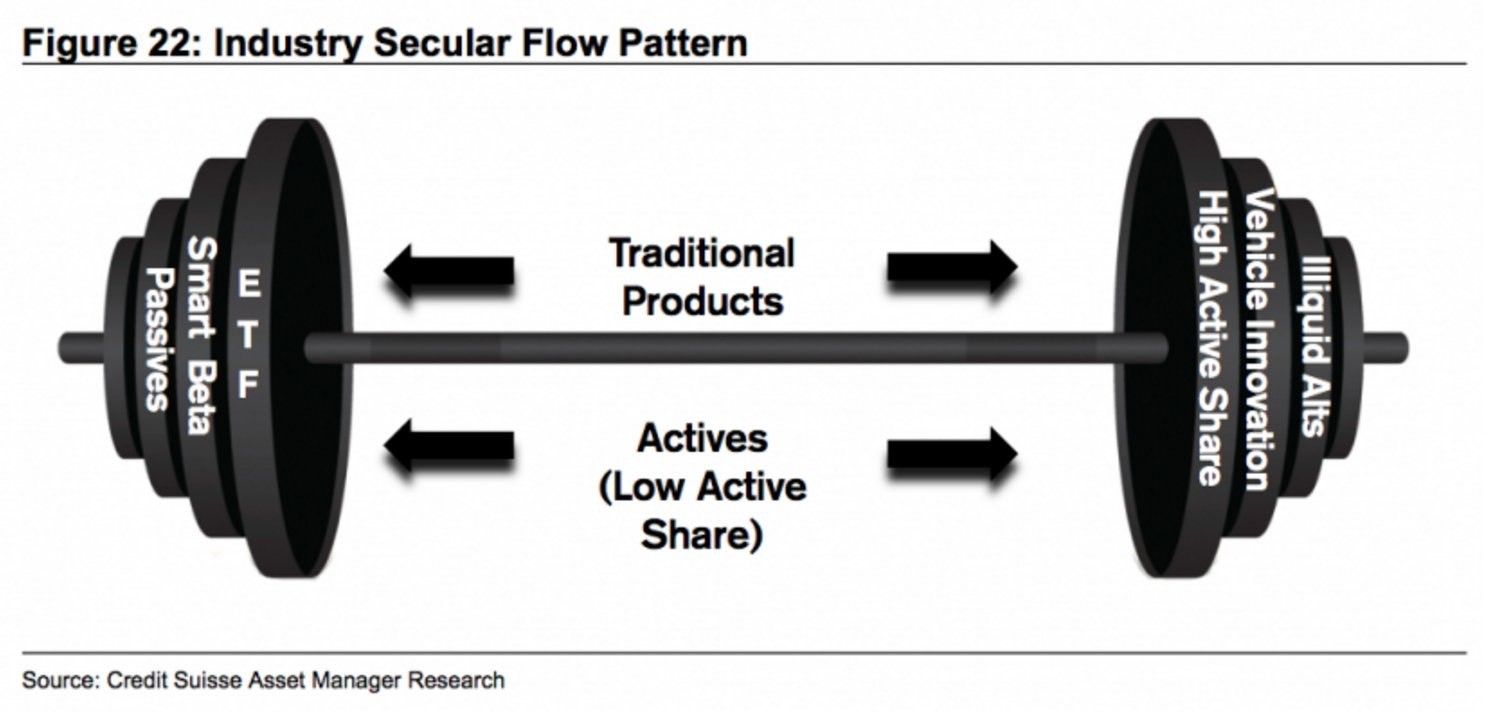

The team at Credit Suisse agrees with our assessment, as seen in this infographic from a research note:

Of course, our interpretations vary, as their view focuses on flows (hence ETFs) rather than profit. They rightly note that flows have moved into the belly of the curve, whereas our framework focuses on the value accrued by the investment manager playing in each space.

“Pure arbitrage” investment strategies are designed to provide uncorrelated alpha, and those uncorrelated alphas are as valuable today as ever. On the other end of the spectrum, “pure speculation” investments provide potentially exceptional rate of return and are increasingly oversubscribed, such as the most desirable venture-capital funds in the world.

Strategies that sit in the middle are either facing severe fee compression, are re-branding themselves as differentiated, or are following the commodity scale player in a race to the bottom on fees. As a result, we’re seeing consolidation in the ETF space, while “index huggers” continue to bleed assets / slash fees. The key point is that strategies centered upon a beta are turning into the manufacturing leg of Shih’s smiling curve. If your value proposition is purely beta-oriented (or even beta-manipulated), you’re prone to disruption. To demonstrate the application:

In short:

Asset managers are trying to paint themselves as either uncorrelated sources of return, or exceptional rates of return, as they dare not compete with Vanguard and Blackrock as a scale-provider of beta.

Beta has become the de facto commodity in the “supply chain”, where abnormal profits go to die.

It will be interesting to see how “beta manipulators”, such as risk parity strategies, adapt from a profitability/desirability standpoint.

—

The information contained on this site was obtained from various sources that Epsilon believes to be reliable, but Epsilon does not guarantee its accuracy or completeness. The information and opinions contained on this site are subject to change without notice.

Neither the information nor any opinion contained on this site constitutes an offer, or a solicitation of an offer, to buy or sell any securities or other financial instruments, including any securities mentioned in any report available on this site.

The information contained on this site has been prepared and circulated for general information only and is not intended to and does not provide a recommendation with respect to any security. The information on this site does not take into account the financial position or particular needs or investment objectives of any individual or entity. Investors must make their own determinations of the appropriateness of an investment strategy and an investment in any particular securities based upon the legal, tax and accounting considerations applicable to such investors and their own investment objectives. Investors are cautioned that statements regarding future prospects may not be realized and that past performance is not necessarily indicative of future performance.