Three Observations: October 2022 - China Worries

1. We’ve written about the issue with Chinese focused American Depository Receipts (“ADRs”) in prior investor letters, explaining our decision to effectively curb these exposures from our portfolios. Ownership – the bedrock of equity investing –of Chinese companies through ADRs is obfuscated through the use of variable interest entities, nevermind the increasingly capricious nature of Chinese rule of law. Your author recalls buzz about this issue in 2015, circa the Alibaba IPO. Some fervor returned in 2019 when the US / China political relationship began to deteriorate, just as other Chinese technology giants (such as Pinduoduo and Tencent) were taking off. You had a mixture of optimism towards exciting new business models (superapps, social e-commerce) and skepticism (decoupling, rule of law) and many bumps along the way (e.g., Common Prosperity).

Perhaps we are reaching a crescendo, as Chinese equity markets reacted on Monday by vomiting, with technology ADRs (as tracked by the KWEB ETF) down 17% for the day, and down mid 60s for the trailing year:

There is of course an ironic Mungerism about knowing what you own, a fundamental principle not readily available to holders of dubiously audited VIEs.Ironic because Munger himself has been quite the Alibaba bull.

2. But wait, isn’t a wise trope that “there is no bad risk, only bad price?” I’d love to know the initial source of this piece of wisdom (I find a Bloomberg quote of it dating back to 1992 by a certain insurance trader named Art Lyon). In a nutshell, yes and no. Yes, because risk (versus uncertainty) can be priced to a degree that protects even the ugliest tail-outcome. However, this type of risk fundamentally requires serial at-bats to provide diversification. Just ask cat bond holders.

No, in the sense that First Principles Thinking should cleave away vast opportunities for the judiciously minded, avoiding the connundrum of 'pricing' radical uncertainty. If there is governance issues, one should not buy. Full stop. We’ve written about this in the context of supervoting shareholder classes.

Most investors frankly fall somewhere in-between, perhaps haircutting their position sizes for companies that have these concerns, falling short of avoiding them entirely. With this mentality, our fear is that bull/bear cycles will pull one too far in one direction versus the other, just at the point of maximum pessimism/ebullience. In our opinion, the key is to stick to one side, avoiding the whipsaw. It would be a shame for a Chinese tech bull in 2019 to face a string of governance-based maladies, leading them to exit the space at a potential point of maximum capitulation. On the other hand, there is always a long way to go down to zero!

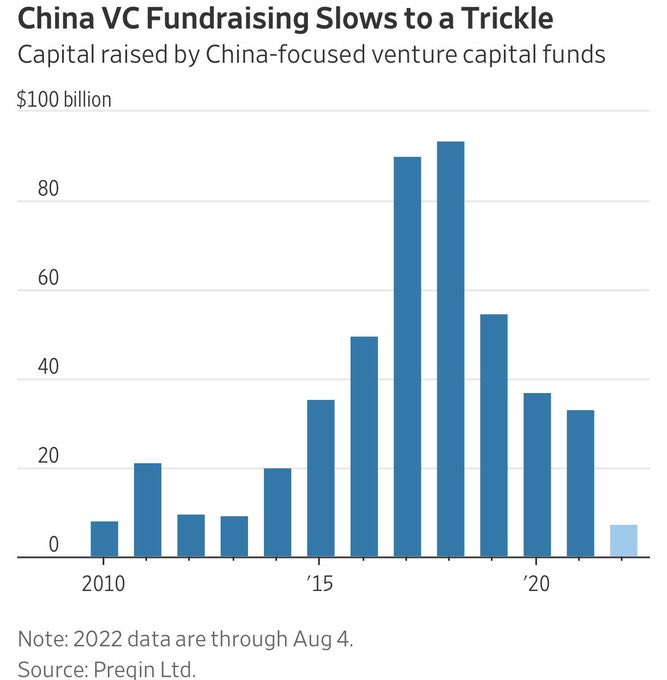

3. But with a growing cleave between Western and Chinese political economies, what are investors left to do? This is a tough question and of course an even tougher political situation. We are already seeing signs of deceleration across venture investments and increased governance risks associated with public delisting. Capping this off with the changing complexion of the Chinese politburo, away from more ‘globalist’ and ‘open trade’ types towards more ‘loyalist’ and ‘hawkish’ types, the increasing fear for Western investors is that of complete detachment with all of its attendant consequences.

---

Featured Image generated by Dall-E 2 per OpenAI’s Terms of Use.

The information contained on this site was obtained from various sources that Epsilon believes to be reliable, but Epsilon does not guarantee its accuracy or completeness. The information and opinions contained on this site are subject to change without notice.

Neither the information nor any opinion contained on this site constitutes an offer, or a solicitation of an offer, to buy or sell any securities or other financial instruments, including any securities mentioned in any report available on this site.

The information contained on this site has been prepared and circulated for general information only and is not intended to and does not provide a recommendation with respect to any security. The information on this site does not take into account the financial position or particular needs or investment objectives of any individual or entity. Investors must make their own determinations of the appropriateness of an investment strategy and an investment in any particular securities based upon the legal, tax and accounting considerations applicable to such investors and their own investment objectives. Investors are cautioned that statements regarding future prospects may not be realized and that past performance is not necessarily indicative of future performance.