Inflation: The Fed Model

This excerpt is lifted from Epsilon's 3Q22 investor letter, released October 5th, 2022. This is the fifth piece in a series of posts reviewing the academic literature on asset class behaviors during inflationary conditions.

A volatile macroeconomic backdrop has investors seeking the sidelines. We’ve witnessed several equity bear market rallies that have failed to overcome tepid macro readouts, shaking investor confidence. The root cause of this undulation and pessimism could be attributed to trenchant inflation and a hawkish response from the fed, but initial valuations shouldn’t be so easily forgotten.

These stresses have started to present cracks in financial stability. Rumors swirl around certain investment banks, precarious emerging market (nay, developed market!) currencies, and heightened counterparty risk. Rumors can be self-fulfilling when it comes to liquidity crunches, which is a perilous position for markets. The Fed will now have to reevaluate its resolve toward inflation given the specter of kindling financial calamity.

At the root of it, the principal question equity investors are struggling with is, what constitutes a reasonable equity risk premium[1]? With effective fed funds rates at levels we haven’t seen in quite some time, investors are being offered an alternative to the ‘equities only’ framework of the last bull market. Clipping marginally appetizing yield at the front end of the curve seems compelling to some licking their equity market losses. But what does this mean regarding equity valuation, perhaps the most important overhang to broader risk assets? Will multiples be pressed down by capital flows rotating out of stocks and into bonds? Should equity investors who analyze markets through this framework – colloquially called The Fed Model – be worried?

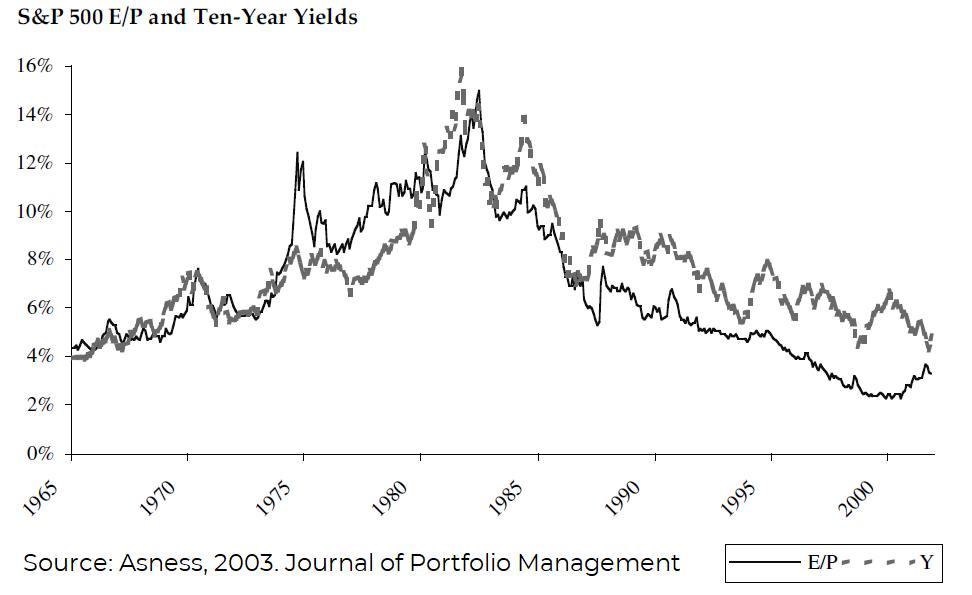

When it comes to equities vs bonds, their relative attractiveness, and the measurement of equity risk premia, there is a tendency for investors to conflate certain concepts. At the core, one must disentangle the impact of real vs nominal rates on asset classes and risk premia. Many think that higher rates should result in lower multiples for equities. If one thinks of the ‘earnings’ multiple of a 10 year treasury as the yield divided by the maturity, then there seemingly should be a strong correlation between earnings yield and treasury yield. This is empirically observed (see chart below). However, investors should be careful in extrapolating forward return expectations.

In his 2003 paper entitled, Fight the Fed Model, Cliff Asness lays out why the Fed Model is not a useful predictive tool for long-term stock returns and that augmenting it with a gauge of investor risk appetite could lead to a better estimation of equity risk premia. He claims the Fed Model is, at best, a manifestation of a persistent investor error. This mirrors the analysis of a prior paper on Inflation (Money Illusion), which we wrote about previously.

In the paper, Asness analyzes the three common rationales investors give for using the Fed Model: a competing asset argument, a dividend discount analysis, and the simple empirical observation as the chart highlights above. Asness dismantles each, wherein investors falsely conflate the pass-through of real equity earnings, where inflation is effectively baked into the cake, with the nominal level of bond yields.

Regarding discount models, Asness highlights how real earnings of stocks should not simply go up when long-term inflation goes down. This oversimplifies things, given the confluent impact on economic output, the key corollary to earnings. And yet investors expect it, as such[2]. He chalks up the empirical correlation between earnings yield and treasury yield to investor error, which he demonstrates through regression frameworks over 100 years. This analysis demonstrates that the Fed Model does not predict proceeding 1-, 10-, or 20-year returns. Its predictive power is statistically insignificant and much weaker than relying on simple market valuation.

The final nugget of wisdom from the paper is unpacking how investors can make a better prediction of equity risk premia than simply comparing the relative yields of equities and treasuries. By incorporating the historical volatility of both, he theorizes that investor’s risk aversion can be incorporated into a forward-looking assessment. Follow-on scholarship demonstrates that this is a potent and replicable approach to proxying equity risk premia.

All of this is to say, do not make a long-term forecast of equity returns based upon a relative valuation of real earnings vs nominal bond yields. But there is something to be said about perceptions and investor flows. Investors who aren’t avowedly long-term oriented must pay attention to how the perception of this relationship will drive near-term behaviors. The so-called Keynesian Beauty Contest.

[1] For a good primer on ERP, we suggest Damodaran (2020)

[2] the so called Money Illusion as described by Irving Fisher in 1928

The information contained on this site was obtained from various sources that Epsilon believes to be reliable, but Epsilon does not guarantee its accuracy or completeness. The information and opinions contained on this site are subject to change without notice.

Neither the information nor any opinion contained on this site constitutes an offer, or a solicitation of an offer, to buy or sell any securities or other financial instruments, including any securities mentioned in any report available on this site.

The information contained on this site has been prepared and circulated for general information only and is not intended to and does not provide a recommendation with respect to any security. The information on this site does not take into account the financial position or particular needs or investment objectives of any individual or entity. Investors must make their own determinations of the appropriateness of an investment strategy and an investment in any particular securities based upon the legal, tax and accounting considerations applicable to such investors and their own investment objectives. Investors are cautioned that statements regarding future prospects may not be realized and that past performance is not necessarily indicative of future performance.