Position Sizing

- Perfecting the art of position sizing is a daunting task, one that takes years to master

- Investors need to be clear (both internally as well as externally) about their approach to drawing alpha out of a position sizing framework

- Any successful approach begins with a priori data capture and honest self-examination

- It continues with disciplined implementation, in the face of anecdote and randomness

- It culminates with client relationships that facilitate ideal (but often harrowing) position bets, unlocking mutual value creation

Position sizing can be as important a driver of portfolio outperformance as security selection.This is most notable in public markets, where position sizing is adaptive. Everyone intuitively understands this. But many investors struggle with clearly communicating their position sizing philosophy. This is often because discretionary managers avoid formulaic approaches toward portfolio construction. Position sizing is often hashed out in meetings, culminating in an autocratic decision. “Let’s leg in and assess the unknown blind spots.” “I don’t feel good about the downside asymmetry.” “We need to build this into a core position before it runs away from us.”

Why can’t position sizing be reduced to a rule? There are extensive studies that leverage Bayesian update frameworks, or apply Kelly Criterion to sizing portfolio ‘bets’. There are tools available to analyze the efficacy of bets as well as a priori decision-making. We know because we used to build them. The difficulty today isn’t in tooling. It’s with follow-through. That starts with adhering to the practice of measurement. It culminates in complex interaction effects formulating a portfolio.

Uncertainty

Probability judgments are attached not to events but to descriptions of events - Amos Tversky

Let’s start with a key problem with position sizing: uncertainty. Uncertainty represents the range of expected variance for a position. It can be as simple as a binary decision (e.g., earnings miss/beat), or a complex set of outcome (e.g., 25% probability they get beaten to market, 45% they are top 3 player, 30% they dominate). Uncertainty is something every investor must focus on, as a firm understanding of its impact on sizing clarifies the process of filtering information and improving decisions.

If there were a direct correlation between our prior uncertainty for an outcome and its ultimate realization, position sizing would be much easier.That is to say, when we make a portfolio decision, if we could accurately map the breadth and probability of outcomes, sizing those bets would be a far easier endeavor. There would be no moving target. For example, if we enter a position with a 60% probability that it will generate alpha, we first need to know how likely that probability assessment is accurate. We can only do so by comparing our priors to our outcomes. This is called creating a base rate. Forging that link is extremely powerful because it ultimately unlocks the potential of one’s edge.

Corraling Uncertainty // Unlocking Value

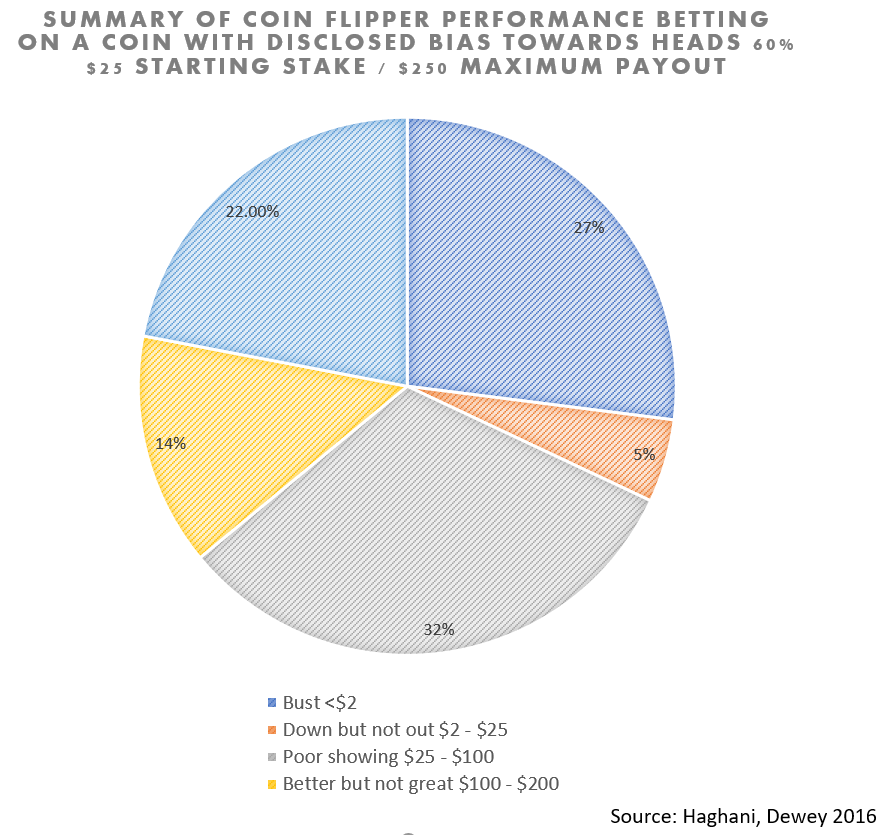

Let us walk you through why controlling uncertainty is so powerful. A 2016 study by Haghani and Dewey showed just how lucrative a zero uncertainty 60% edge is in a simple binary outcome. It also showed us just how naïve relatively numerate finance students in college were to that value. The study does so through an examination of bet sizing on a loaded coin flip experiment.

To summarize the experiment, students were offered to play a game, where they start with some capital ($25) and could bet as much of their pot on successive coin flips for 30 minutes. This coin lands 60% heads instead of 50%. Effectively, they are entering a bet with perfect a priori certainty + strong odds. The goal is to maximize their winnings. Almost all of the participants intuitively understand that you want to bet heads. Almost all understood that the bets were independent. The question boiled down to sizing the bets in order to maximize the outcome.

Interestingly, the expected value of such a proposition is astronomical.The implied value is approximately 128,000 times the principal[1]! And yet, very few participants maximized the expected value of the experiment[2].Only ~20% of players (see figure 1) hit an arbitrary max (just 10x). In fact, nearly 30% went bust! This edge is much easier to squander away than you think, and this is largely a function of position sizing. If you approach this bet by betting pennies because you think it is a safe way to pickup incremental gains, chances are you won’t end up with much. It misses the magnitude of the advantage at hand. A simple application of the Kelly Criterion for such a proposition tells us that consistently betting 20% of total asset is optimal. Few test participants were able to deduce this intuitively.

Stockpicking Edge

Let's translate an undergrad experiment to the best investors in the world. You may think that highly educated, expert portfolio managers do better than 60% in cultivating stockpicks. So why aren’t they 128,000x’ing their money over a career!? After all, a 50/50 outcome is a coin flip. Surely talented fund managers can achieve 60% accuracy. Surely they know this and size their bets as aggressively as Kelly implies?

Here’s the rub. 60% betting in equity markets[3] is rarefied air. Very few investors achieve this over a significant sample. And if they do, markets adapt, and their edge may falter. Things are messy in pari-mutuel systems like stock markets. Uncertainty varies dramatically given the situation. Some situations are straightforward, while others are at best murky.

In addition, equity markets do not provide discrete outcome (heads I win, tails I lose) as you may find through binary instruments like European options, or coin flips. They are continuous. Boiling down portfolio constituents to unique bets is less than straightforward. Is a bet a single position, or each ‘trade’ associated with that position (e.g., tranches of the same security, or legs of a trade if the idea is more complex)? Parsing that out isn’t trivial and must be tailored to the investment style.

Finally, equity investors aren’t only interested in maximizing ending capital. Many are trying to do so with as little risk as possible.While focusing solely on compounding would be ideal, the means by which we do so can engender unruly risk, threatening the endeavor before it reaches its conclusion. This is why you rarely see unhedged 20% positions in fund manager portfolios. Even with clairvoyant 60/40 edge and zero uncertainty, the pain felt by the 40% of misses is a real headwind to implementing such a strategy[4]. All of this goes to say, it’s not as simple as flipping a weighted coin and applying a standard formula. Investors must grapple with this more complex situation with a clearheaded plan. We can speak to how each of these impact Epsilon’s philosophy towards position sizing.

Know Thyself

You do not rise to the level of your goals. You fall to the level of your systems. - James Clear

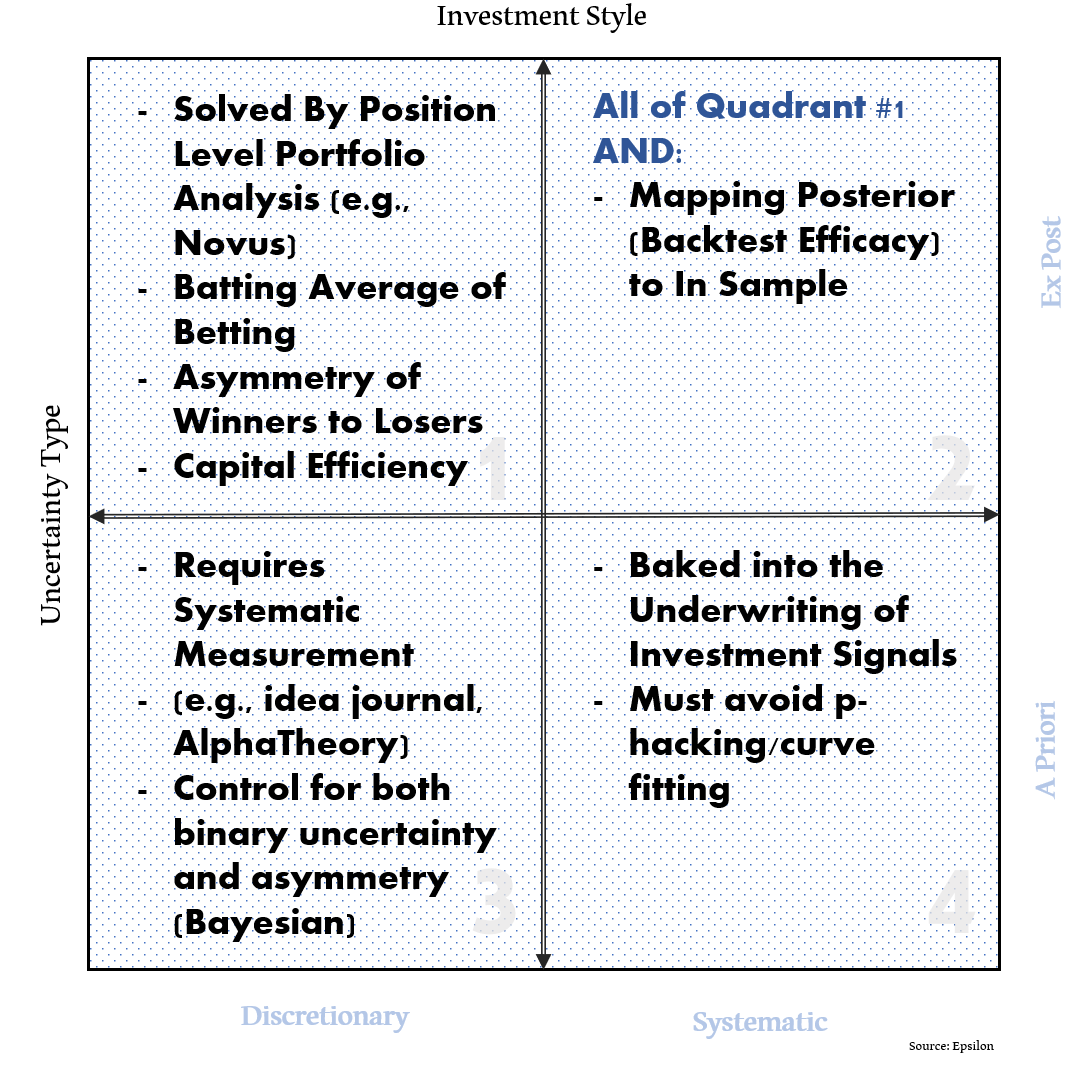

If we want to be measured about optimizing position sizing, we have to collect data. And it’s hard to measure one’s accuracy a priori[5] without a meticulous process. This is much easier to implement if you are a systematic investor. At Epsilon, we trade in systematic, completely discrete intervals, and we measure the efficacy of each realized bet to our forecast (box 4, figure 2). Because each interval is discrete, all comparisons can be made on equal footing without normalizing assumptions. That is, we aren’t commingling an IPO held for 3 days with a core position held for 3 years.

Through this rigid portfolio construct, we developed an expectations framework that starts with our underlying research. This is the foundation of the investment approach. We measure base rates for each trade based upon implied a priori efficacy through our research / live implementation. What that means is, we can measure the efficacy of our signals and thus tailor our expectations based upon that research with our live implementation, setting emotion and capricious whim aside.

An expectations framework is a key concept, because without it, you can’t be scientific in your betting process. It allows us to apply the a prior efficacy of our backtesting to a position sizing framework. This must be done carefully, as there is significant risk with leaning on a backtest. With that being said, the goal is to achieve optimality with margin of safety given the adaptive nature of markets. If your research process is robust (avoiding overfitting), it unlocks the ability to understand your internal base rates with far better efficacy than a haphazard process.

Understand your Risk Tolerance

Every investor likes to think of themselves as fearless in the face of periodic risk. They preach their steel nerves and “ability to be greedy when others are fearful”. While there is undoubtedly a spectrum of ability as it comes to emotionally dealing with volatility, there is a less discussed issue at hand: the risk placed upon the business endeavor.

Owners of asset management firms are not only fiduciaries to their clients, but responsible for a firm (filled with people!), and sensitive to their reputation and livelihood. This rears its head in ugly ways when markets are volatile, like seeing your life flash before your eyes. We at Epsilon don’t think we are immune to human emotion. In fact, analyzing the way I used to trade my PA proves to me that I am just as vulnerable. That vulnerability simply reinforces the value of systematic trading for our success. This is a personal conclusion, where we structure our investment process to forbid us from emotionally reacting to market stress. We find doing so allows us to stay true to our research in the face of exigent circumstances. Coming out of these periods only strengthens our adherence to a systematic approach.

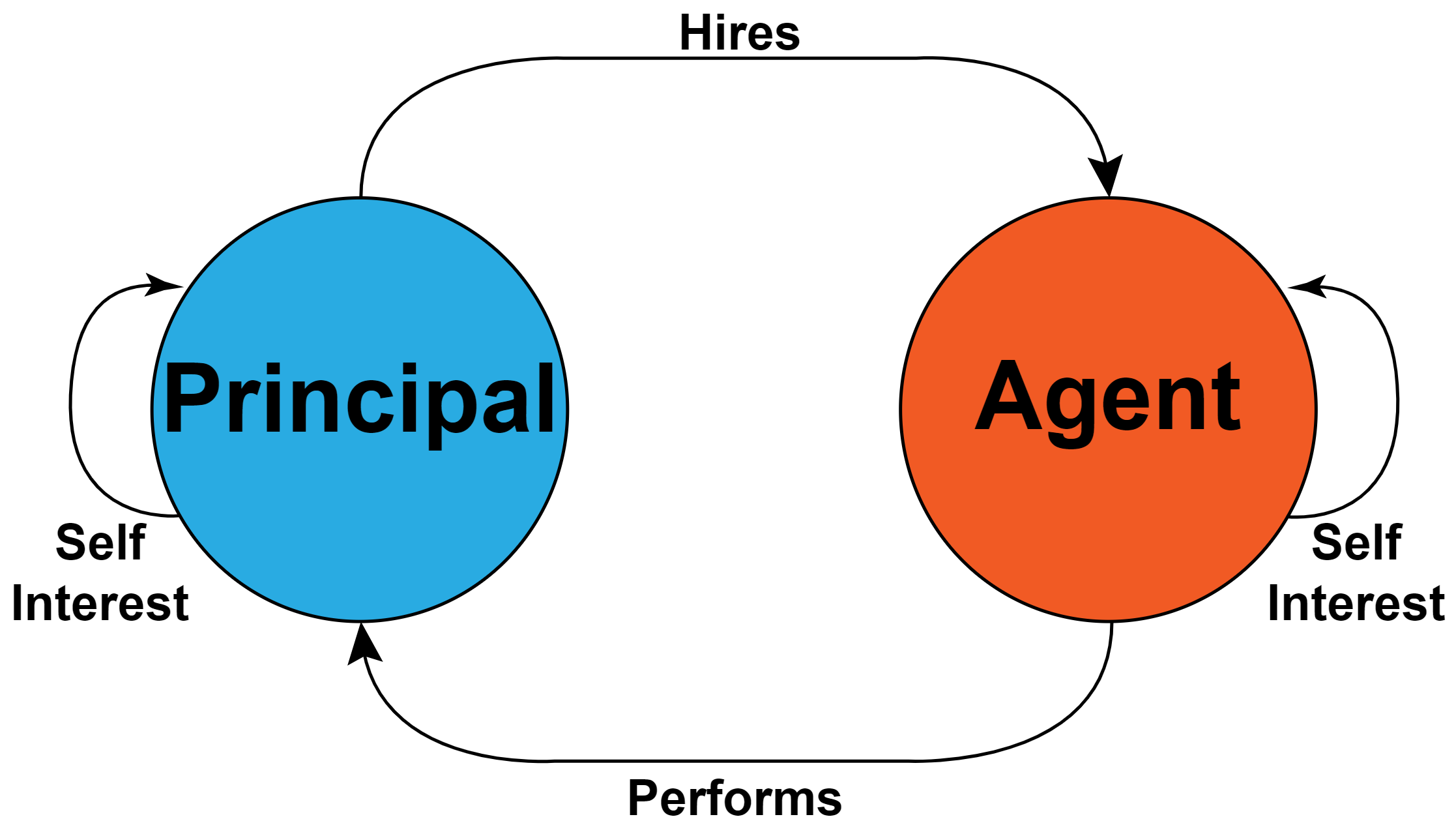

Principal/Agent Issues

For a fund manager, often there isn’t a single thing to be done when opportunity presents itself. The thing to be done was when alignment of objectives was first hashed out with one’s clients, not when the VIX is spiking. Opportunity favors the prepared, and to that end, cutting corners by having weak client relationships invariably comes back to bite you. Taking well measured – but what can feel like truly harrowing – bets can’t be an on/off switch. Its foundation is a well-formed relationship with one’s client capital.

As an example, we amplified one of our client’s position-sizing bets earlier this year having spent years developing a firm relationship, hundreds of hours underwriting an enhancement to our betting, as well as multiple calls, meetings, and dialogues communicating our thinking. This was the upfront work required to put in place a sizing framework that unlocks value. Case in point: we enacted said change for our client in February, before the market volatility hit. It was not ‘perfectly timed’, catching the depths of equity market's swoon in late March. By then, it was too late to do a thoughtful examination of such a change if you factor in the communication required to get a client comfortable with such a change.

By putting in the time beforehand, the sizing framework wasn’t relitigated as the markets hit severe turbulence. We liken this to a pilot who can reach for experience and training because it is codified into muscle memory, rather than fumbling through a manual while communicating to the cabin. The betting framework has since driven outsized results. In the end, that outcome was a function of the process, not of the transient opportunity.

Like all things position-sizing, preparation is most of the battle.

[1] The authors assume ‘quick’ 6 second flips, leading to 300 flips in the allotted time, and the Kelly fraction of 4%.

[2] The study practitioners capped the payout because the implied value was orders of magnitude larger than the $25 participants started with, so we are generalizing “expected value maximization” with participants who reached the limit of $250.

[3] Let’s define that as % of securities which generate superior ROIC than a representative beta.

[4] An interesting counter-experiment to Haghani and Dewey might be to setup the same rules but have the objective function be optimal Sharpe ratio of PnL rather than dollars accrued!

[5] remember – the link between prior uncertainty and realized outcome starts with the a priori!

—-

The information contained in this article was obtained from various sources that Epsilon Asset Management, LLC (“Epsilon”) believes to be reliable, but Epsilon does not guarantee its accuracy or completeness. The information and opinions contained on this site are subject to change without notice.

Neither the information nor any opinion contained on this site constitutes an offer, or a solicitation of an offer, to buy or sell any securities or other financial instruments, including any securities mentioned in any report available on this site.

The information contained on this site has been prepared and circulated for general information only and is not intended to and does not provide a recommendation with respect to any security. The information on this site does not take into account the financial position or particular needs or investment objectives of any individual or entity. Investors must make their own determinations of the appropriateness of an investment strategy and an investment in any particular securities based upon the legal, tax and accounting considerations applicable to such investors and their own investment objectives. Investors are cautioned that statements regarding future prospects may not be realized and that past performance is not necessarily indicative of future performance.