Three Observations - May 2022

The first in a semi-frequent series of short market perspectives.

1. The curious case of crossover investors

The last few years in tech has seen a tail wags the dog effect between public and private valuations. Public markets looked to privates, mimicking multiple expansion upon increased growth. With many tech darlings facing the most severe drawdowns we’ve seen since the 2000 tech crisis, one would assume a softer environment for private marks, and we’re beginning to see that on the fringe.

One area we’ve paid attention to are crossover investors. They uniquely have flexibility to seek value across the chasm, and we’ve been somewhat perplexed to see some of these firms continuing to headline rounds in private markets. This may simply be because they are finding those unique circumstances particularly attractive, or it may be a division of capital in certain funds between privates and publics. But our sneaking suspicion is that the private markets offer a wedge between terminal value creation and asset management business value creation. They do this by offering the fund manager another avenue for raising assets: ensuing up rounds.

As up rounds are by far the safer bet than a rising stock price, they derisk the business' return on capital deployment and its ability to substantiate returns that feeds the next cycle of capital commitments. We view this as a pretty glaring principal/agent risk and something smart LPs should be asking: why incur illiquidity, an uncertain IPO window, and speculative valuations when many of the same darlings of yesteryear are trading at valuations unseen for half a decade?

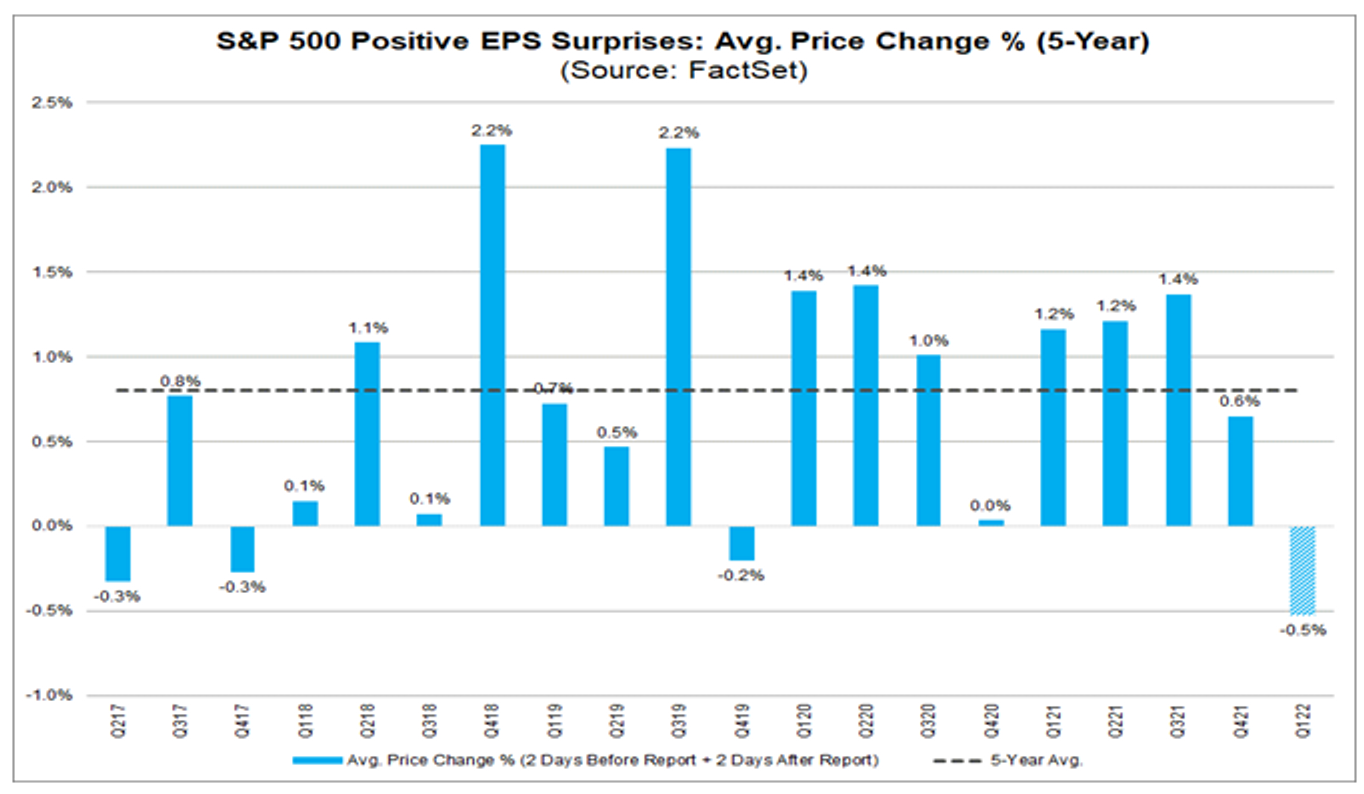

2. Asymmetric earnings response

We’ve talked about earnings response coefficients in the past. The general mood of this earnings season has been one of asymmetric downside. Report a fantastic beat and your stock may hover near its moving average. Report a miss or provide guidance that invokes macroeconomic uncertainty? Prepare for the whirlwind. This suggests the prevailing macro uncertainty is tinted by pessimism. Investors reacting to earnings aren’t trying to parse why travel and credit card data are strong but certain advertisers are showing weakness, or why retailers are building inventories. They are selling when given the excuse. Shoot first, ask questions last.

It is our observation that in the last few years, investors have been comfortable pouring capital into opportunities surrounding upside uncertainty (sure this company doesn’t have profits, but if the stars align, this is 10x) versus opportunities surround downside uncertainty (this company is decelerating, but the fcf will be there if they make painfulstructural changes, and so we will be buying at a bargain). The only firms seeking convex payouts with downside uncertainty appear to be distressed debt investors, and they are currently feasting on non-profitable companies that did not amass liquidity provisions when the party was still going.

3. A geocentric to heliocentric shift?

For the better part of the last decade, investors have rewired the way they underwrite boom firms, accepting lack of clarity regarding terminal profitability for disruptive innovation. This created what we have called a rewiring of investment underwriting. We’ve invented new vernacular for this style of investing. Terms like Rule of 40, Gross Margin, and adjEBITDA (glib, I know). The sheer amount of reinforcement learning sustained through massive profits will be a hard thing to unwind if this was an aberration, or a cyclically dependent way of viewing the world.

This is the difficult thing about markets: we may get feedback for a decade that suggest the earth is in the center of the universe, only to see a flaw in our model over the ensuing three decades that comports with the past. If this is the case today, then the geocentric model epitomized by Rule of 40 will be replaced by the heliocentric model of CREAM: Cash(flow) Rules Everything Around Me.

---

The information contained in this article was obtained from various sources that Epsilon Asset Management, LLC (“Epsilon”) believes to be reliable, but Epsilon does not guarantee its accuracy or completeness. The information and opinions contained on this site are subject to change without notice.

Neither the information nor any opinion contained on this site constitutes an offer, or a solicitation of an offer, to buy or sell any securities or other financial instruments, including any securities mentioned in any report available on this site.

The information contained on this site has been prepared and circulated for general information only and is not intended to and does not provide a recommendation with respect to any security. The information on this site does not take into account the financial position or particular needs or investment objectives of any individual or entity. Investors must make their own determinations of the appropriateness of an investment strategy and an investment in any particular securities based upon the legal, tax and accounting considerations applicable to such investors and their own investment objectives. Investors are cautioned that statements regarding future prospects may not be realized and that past performance is not necessarily indicative of future performance.