Trading Stripes

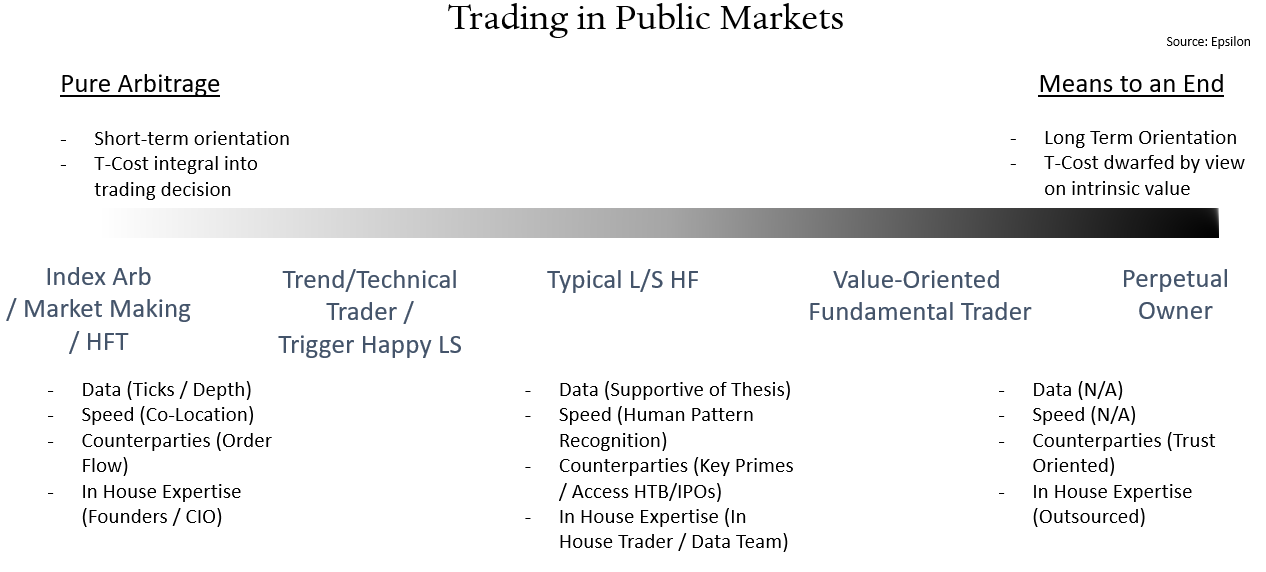

Trading defines markets. It is the act which brings price discovery. Different market participants use trading in different ways. For some, it is a pure form of arbitrage. They can find situations that unearth profits with limited risk. For others, trading is a means to an end; the starting point toward putting capital to work. These aren’t binary motivations. They lie on a spectrum. Much as we wrote about the spectrum of arbitrage to speculation, there is also a spectrum of trading styles:

On the left side, we have the epitome of the arbitrageur: the high-frequency trader. Their trading is integrally tied to the cost of transacting as arbitrage is increasingly pushed to the frontier of transaction cost. Arbitrageurs are looking for relative edge, which has its associated costs: co-location (speed), data (ticks, depth), computational strength /algorithmic superiority (ability to adapt to patterns which reduce directional risk), and counterparty relationships (order flow).

On the right side, we are talking about perpetual ownership investors: the Warren Buffetts of the world. For them, the actual cost of transacting is de minimis when spread across (potentially) years of ownership. This is not to say they are oblivious to bid/ask spread. Rather, trade optimization is outside of their focus and thus not their core competence.

The perpetual holder conforms their allocation decisions around different costs associated with trading. They are increasingly adapting their organizational structures to conform to this optimization. These include taxation through capital gains or dividends, as well as the efficient re-allocation of free cash flow.

Where you as an investor fall on the spectrum should be carefully analyzed as it should shape many aspects of your business. That evaluation should be driven by an introspective assessment of one’s core competence. While many investors have a good idea of this, their manner of trading is often overlooked as a corollary.

Information Edge and Trading Patterns

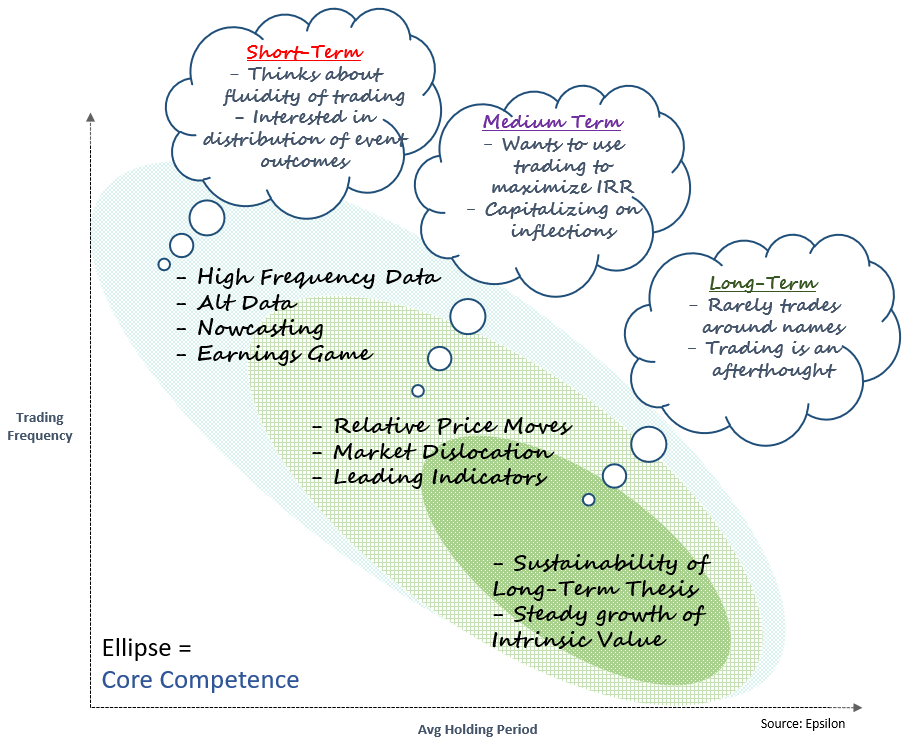

Let’s drill into this concept of core competence and trading pattern. To simplify the equation, let’s assume there are three frequencies of information advantage that define an investor: short-term (anything up to 1 quarter of holding), medium term (from one quarter to several years), and long-term (in excess of three years):

Long Term Investors

Starting with the long-term investor, they have expertise in understanding the competitive advantage of a company, how durable that advantage is, and the ability of the company to sustainably redeploy capital to ancillary growth areas. If we were to boil that down to naïve metrics, the first may correlate with return-on-invested-capital, the second with the derivative of that metric (i. e. , the defensibility of ROIC over time), and the third with growth of Total Addressable Market.

E. g., a long-term investor in Google might have identified in early days a superior search product. They might have even seen a clear path towards monetization through advertising. They might have also envisioned an increasing relative advantage in product quality by virtue of data accumulation. They might have had an inkling toward growing addressable market in the form of the increased centrality of search. For good measure, they might have predicted management’s forays into other verticals including video, mobile, email, and so on.

While this is unreasonably clairvoyant, we can tie back this thinking pattern to the long-term investor’s ultimate trading behavior. It is less likely that this investor is interested in earnings reactions given their focus on these three drivers of intrinsic value. While an earnings announcement may provide tangible metrics to support a long-term thesis, they are hardly determinants of whether or not their thesis is correct.

We don’t expect this type of investor to trade around their position heavily, especially if they are cognizant of frictional costs. Even if the company was trading at a multiple that may seem too rich, these investors are often sanguine about trading around their view of intrinsic value to optimize IRR. They are often humble about their ability to do so. This is because such a long-term orientation is philosophically orthogonal to the idea of short-term oscillations providing reliably accurate information. Because of this, trading activity is often sparse. Sparse trading activity means the carrying cost of expertise, data, systems, and acumen is a drag, and thus is outsourced*.

Medium-Term Investors

The medium-term investor has similar traits to the long-term investor and may have investments that mimic in style and duration. Because their holding period is often in years, they will attempt to be tax sensitive with their holdings. A key difference between the medium-term investor and the long-term investor is their belief in adding alpha by capturing second order change.

The medium-term investor is more focused on transformation because they may not have the luxury of permanent capital^ and they may thus be forced into a competitive arena that needs to differentiate during fluctuation. As a function, they drill into relative valuation. Take a situation like Chemours, which was part of a complex corporate action where an industrial conglomerate split. This was during a period of macroeconomic uncertainty surrounding cyclically sensitive investments. The stock dropped >50% after its spin-off. It then rallied over 1000% in the span of two years, only to have another 80%+ drawdown after another two years, capped with a recent rally of 150% off the March 2020 lows.

Here we see several multi-year intervals where tactically trading around these inflections would be key drivers of alpha for a medium-term investor, even if their long-term perspective were in line with the long-term investor. There is significant alpha to be harvested by hitting these inflections. With that also comes the significant risk of underperforming the buy and hold‡.

In order to capitalize, the medium-term investor must have the ability to execute quickly when their process finds those inflection points. If their size is meaningful, that execution must be nearly as competent as a trading-oriented firm, given the importance of capturing dislocations where liquidity patterns can be anomalous. Even though there are shades of long-termism at the core of the investment strategy, trading expertise can dramatically enhance entry or exit prices, and thus IRRs.

Here we often find investors that trade more frequently than you could imagine, because the siren song of timing these inflections is great, and the allure associated with the structure of trading counterparties (capital introduction, research) is self-reinforcing.

Short-Term Investors

Investors that trade around the most common informational events (e.g., earnings) must dial-in their skills to exploit the patterns uniquely associated with these events. There is usually a run-up period to a catalytic event. Information advantage provides visibility into the implied odds surrounding that event. This may be attained through alternative data, channel checks, or other high-frequency assessments. Scuttlebut investors be warned. Pattern-driven catalytic events invite arbitrage. It is table stakes to be competitive in the realm of execution and technological prowess if you are trading around earnings.

Such trading patterns can have a Keynesian Beauty Contest dynamic, where positioning is not predicated solely upon one’s information edge, but on how one perceives the competition digesting that information into the price (undershooting/overshooting). Because these dynamics often lead to somewhat unstable equilibria, options expertise and quick trading are crucial.

An example of this dynamic may be what market practitioners have witnessed in the Earnings Response Coefficient (“ERC”) in the last few years. The trend behind a decreasing ERC was an indication of increased market efficiency. This demonstrated a dampening of abnormal response across securities attributed to the release of quarterly earnings. We’ve seen ERC come down over time as markets have done a better job of digesting expectations and perhaps even front-running them through their higher-frequency updating. But recently, ERC’s have increased, as short-term traders have moved into that Keynesian Beauty Contest, where a higher-frequency signal leads the market to an “offsides” position heading into earnings. Simply trading around the derivative of this (increased vol of response) could be a profitable approach for someone with short-term advantage and an eye for the swimming of the herd.

Uncertainty and Trading

The last wrinkle to add is the constant optionality afforded the investor by a liquid market. No matter how long-term, just about any investor can cut a position if their views have fundamentally changed. To that, trading in the public markets offers a ‘get out of jail free’ card if you re-assess your beliefs. Because wrong and right are not binary in investing, structured trading can change the ultimate distribution of returns whether the investor is terminally right or wrong. This conveys tremendous advantage for investors, say, short-selling in the face of the persistent headwind of market appreciation.

Briefly, in the example of our short-term trader, being first to analyze certain information may cause this investor to put on a position prior to the rest of the market. If so, as this information disseminates widely, said investor has a free option to crystalize profits as that information is absorbed into the market and the price adjusts, irrespective of whether the catalyst confirms their information. They can do so to reduce the impact that uncertainty has with their positioning as well as the offsides effect with the ultimate catalyst which we mentioned earlier.

With the medium-term investor, catching falling knives is just about an impossible task (as is top-ticking exits), so legging in/out of positions can defuse the risk associated with trying to time things perfectly and potentially missing a narrow window. Finally, with the long-term investor, harvesting profits (or cutting risk from adverse situations) helps avoid landmines which can sink a stubborn long-term perspective, and it can assuage the nerves of LPs who look anxiously at unrealized gains.

How Do We Think About Trading

It may be instructive to share introspectively and explain how our trading conforms with what we perceive as our informational edge. Philosophically, we are somewhere between medium-term and long-term. While we may hold a position for as short as a quarter (no shorter), we’ve had an average holding period closer to a calendar year, with certain holdings held since inception.

Unlike the investor decomposition above, we are systematic in our trading and thus look to take advantage of that. First, we don’t include price movement as an input into any of our trading decisions. We feel comfortable with that because we update our priors on a frequent enough basis to avoid situations that can either get too rich or fall into terminal disrepair. This also forces us to measure twice before cutting. Finally, because we trade systematically with rules around position sizing, we are structurally aligned to harvest gains periodically.

This demonstrates a few things about our stripes:

1. We don’t have the degree of fundamental conviction with our holdings necessary to be a blue-blood long-term investor. There has to be that degree of ultimate conviction when things go wrong that allows one to double-down. Instead, our alpha signals dictate whether a security remains relatively attractive, irrespective of whether it has trebled or been cut in half. This saves us a lot of heartburn, but more importantly, it allows us to avoid behavioral biases that persistently destroy value for fundamental investors.

2. We can capture dislocations in names if our signals find them attractive, but we’re not disposed to timing cycles in a security’s pricing in order to maximize IRR. Just as above, we are more worried about whipsawing oneself when trying to over complicate the process. Our research suggests this is less tax efficient approach with our signals.

3. We don’t believe technical prowess around speed, data, or algorithmic execution is a driver of our investment success. While we highlighted the benefit medium-term investors can gain from quality trading and manicured relationships with intermediaries, it doesn’t align with our approach. We trade a handful of times per calendar year and are happy achieving (or slightly beating) a daily vwap with minimal execution cost. Our counterparties don’t provide contingent services associated with these commodity functions, so we ensure their prices are as low as reasonably acheivable.

Because we started with that honest self-assessment, we were able to think clearly about how to allocate time, energy, and counterparty configuration to get what we want out of our trading. What are your trading stripes?

---

* At an investor day, Terry Smith once quipped that he uses his personal account at Schwab to check market prices because he doesn’t want to pay for the non-delayed real time feed on his portfolio screen!

^ As an aside: the structural alignment of a long-term investor is difficult, especially when managing external capital. If one is truly long-term in philosophy, one will be faced with tough choices when companies face inevitable adversity. One will have to determine if that adversity is transient, or terminal. The long-term investor hopes time is on their side, and that the tailwind associated with the compounding of intrinsic value will put them more often in the right than the wrong. A lot can go wrong in between, namely redemptions reducing firepower at the moment of greatest need.

‡A less noted risk is the ability for the LP to generate meaningful dollar alpha from such funds. I can think of a famous cyclically oriented hedge fund that generated industry leading gross alphas but investors on aggregate did very poorly due to their volatility of returns leading to return chasing and unfortunate redemption timing.

---

The information contained in this article was obtained from various sources that Epsilon Asset Management, LLC (“Epsilon”) believes to be reliable, but Epsilon does not guarantee its accuracy or completeness. The information and opinions contained on this site are subject to change without notice.

Neither the information nor any opinion contained on this site constitutes an offer, or a solicitation of an offer, to buy or sell any securities or other financial instruments, including any securities mentioned in any report available on this site.

The information contained on this site has been prepared and circulated for general information only and is not intended to and does not provide a recommendation with respect to any security. The information on this site does not take into account the financial position or particular needs or investment objectives of any individual or entity. Investors must make their own determinations of the appropriateness of an investment strategy and an investment in any particular securities based upon the legal, tax and accounting considerations applicable to such investors and their own investment objectives. Investors are cautioned that statements regarding future prospects may not be realized and that past performance is not necessarily indicative of future performance.